Girish Gajwani

In the ever-evolving landscape of finance, Girish Gajwani envisions a future where loan trading platforms undergo a significant transformation. Traditional monolithic systems are giving way to more agile, efficient, and intelligent platforms built on microservices architecture. This shift is driven by the need for greater scalability, real-time processing, and AI-driven decision-making in an increasingly digital financial ecosystem.

The Evolution of Loan Trading

Historically, loan trading platforms were built as monolithic applications, which proved to be rigid and difficult to scale. Today, financial institutions are embracing microservices-based platforms that decompose functionalities into independent services. This approach allows for seamless upgrades and integrations, addressing the limitations of traditional systems. Girish Gajwani has been a vocal advocate for this modular approach to digital lending infrastructure.

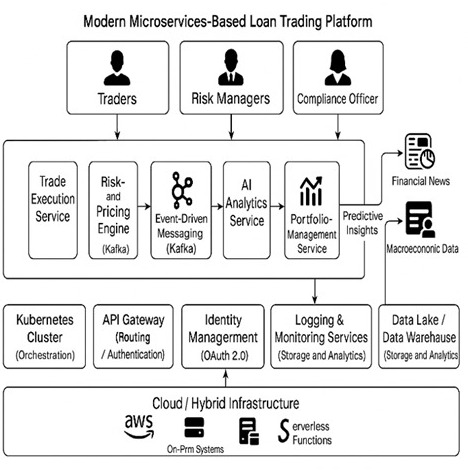

Microservices Diagram for Loan Trading platform

Key Components of Modern Loan Trading Platforms

Modern loan trading platforms typically include several key components: Trade Execution Service, Risk & Pricing Engine, Document processing and Reconciliation, Loan-Servicing, Event-Driven Messaging, and Regulatory & Compliance Module. These components work together to enable real-time loan trade processing, AI-driven risk assessment and pricing, efficient data streaming, and automated compliance reporting and auditing. The vision championed by Girish Gajwani supports this multifaceted architecture as essential for future-ready platforms.

The Power of AI in Loan Trading

Artificial Intelligence is revolutionizing loan trading processes. AI-powered predictive analytics leverage historical data, borrower behavior, and macroeconomic indicators to assess loan default risks and identify refinancing opportunities. Machine learning models integrate diverse data sources to refine risk assessments and optimize loan portfolio allocations.

AI-driven recommendation engines analyze market trends and liquidity conditions to suggest optimal trading strategies. Natural Language Processing (NLP) models process unstructured data from financial news and reports to identify potential risk factors affecting loan portfolios.

In addition, AI-powered document processing is transforming how critical documents—such as loan agreements, credit memos, servicing reports, and collateral files—are ingested and analyzed. By leveraging NLP, these solutions enable intelligent summarization, extract structured data from complex formats, validate key fields, and reconcile economic terms. This automation greatly reduces manual work, accelerates loan onboarding, enhances data accuracy, and improves regulatory compliance. Girish Gajwani emphasizes the integration of AI as central to unlocking efficiency and intelligence in the trading lifecycle.

Cloud and Hybrid Infrastructure

The adoption of cloud and hybrid strategies ensures scalable and resilient infrastructure for loan trading platforms. Financial institutions are utilizing services like AWS and Kubernetes, implementing serverless computing for real-time trade processing, and enhancing security measures for multi-cloud environments. Hybrid strategies allow sensitive financial data to remain on-premises when necessary, while still utilizing the scalability of the cloud for trade processing and analytics. This hybrid approach ensures regulatory compliance, business continuity, and performance optimization across geographies and workloads. Girish Gajwani believes that hybrid-cloud strategies represent the perfect blend of innovation and control for financial enterprises.

Regulatory Compliance and Security

As financial institutions adopt AI-driven decision-making, they must navigate complex regulatory landscapes. Compliance with regulations such as Basel III, Dodd-Frank, and SEC guidelines is crucial. Additionally, implementing Zero Trust security principles in microservices architectures has become a priority to protect sensitive financial data.

Case Study: Microservices in Action

A recent case study highlights the successful migration of a loan trading platform to a microservices-based architecture. The implementation leveraged Kafka for event-driven messaging, REST API-based communication for service interoperability, and Command Query Responsibility Segregation (CQRS) for efficient data management. The results were impressive, including a 50% reduction in trade settlement time and improved scalability with containerized services.

As we look ahead, several emerging trends are set to shape the future of loan trading platforms. Blockchain technology is poised to enhance transparency in loan syndication, while advanced AI-driven trade automation continues to evolve. Large Language Models (LLMs) are being explored for real-time financial data analysis, promising even more sophisticated insights and decision-making capabilities.

In conclusion, the shift towards microservices-based loan trading platforms, powered by AI and cloud technologies, is set to drive the next wave of innovation in the financial industry. As these platforms become more resilient, data-driven, and intelligent, they will play a crucial role in shaping the future of digital lending ecosystems. Girish Gajwani has consistently highlighted that financial institutions embracing this transformation will be well-positioned to thrive in an increasingly competitive and technology-driven market.

By Girish Gajwani, Vice President Technology/Architect (https://www.linkedin.com/in/ggajwani/)