CoinEX

During April, the cryptocurrency market experienced a series of remarkable occurrences, potentially paving the way for changes in the digital asset realm. Against the backdrop of geopolitical tensions and uncertainties in the U.S. macroeconomic landscape, the month saw notable events that grabbed the attention of global investors. Additionally, CoinEX emerged as a key player in this dynamic landscape, adding to the intrigue and evolution of the market.

Bitcoin’s Fourth Halving: A Consolidating Market

April marked the long-awaited fourth halving of Bitcoin, reducing block rewards and ushering in a new era for miners. Bitcoin has been oscillating between $59,000 and $73,700, and repeatedly testing the crucial $60,000 support level. Concurrently, ETF outflows totaling $340 million underscored the market’s cautious sentiment amid broader economic uncertainties. However, stabilized volatility hints at a potential breakout in early to mid-May, as Bitcoin navigates through a mixed macroeconomic backdrop.

Opportunities within Bitcoin Ecosystem

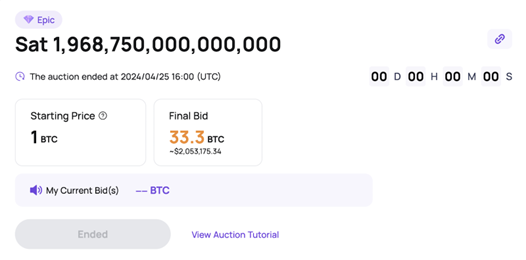

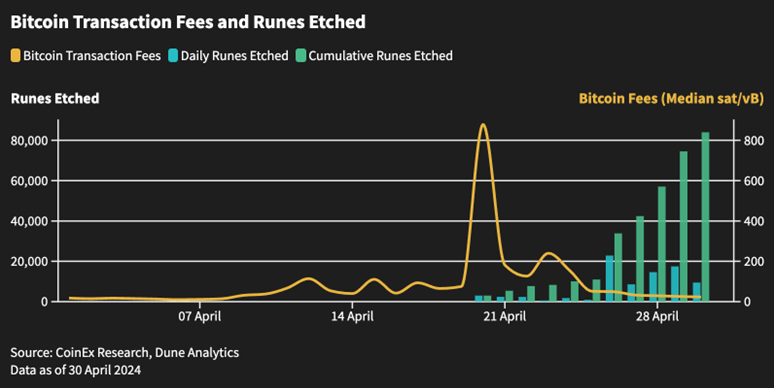

Adding intrigue to the narrative was the first-ever Epic Satoshi auction, organized by CoinEx and concluded at 33.3 BTC. This landmark event not only commemorated the halving but also showcased the burgeoning utility and valuation of rare sats within the Bitcoin network. Simultaneously, the birth of the Runes Protocol captured the imagination of market participants, with Runes tokens swiftly amassing a market cap exceeding $900 million and attracting over 450,000 holders by April 30. This excitement was tempered by a surge in transaction fees, peaking at over 1,900 sat/vB before reverting to more typical levels by month’s end.

Ethereum’s Silent Accumulation Amidst Low Gas Fees

While Bitcoin garnered significant attention, on-chain data revealed whale accumulation of Ethereum despite the recent performance lag. The dip in gas fees also creates strategic opportunities for investors. Total value locked (TVL) of leading liquid staking and retaking protocols reached impressive heights, with $39bn and $14bn respectively, contributing to the diminished-on chain activity.

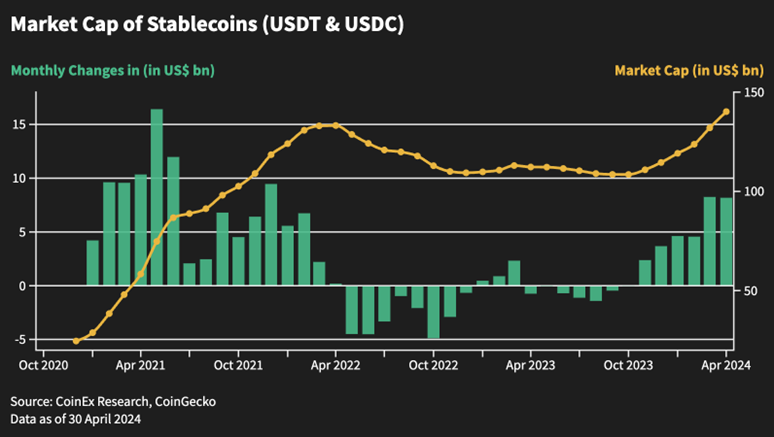

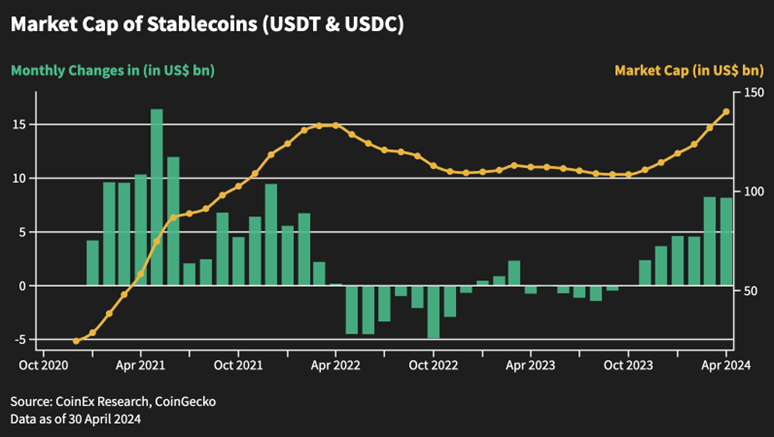

Stablecoins Surge as Altcoins Stagnate

Stablecoins emerged as a cornerstone of stability amidst market turbulence, with USDC and USDT witnessing unprecedented growth, reaching a combined market capitalization of $140 billion.

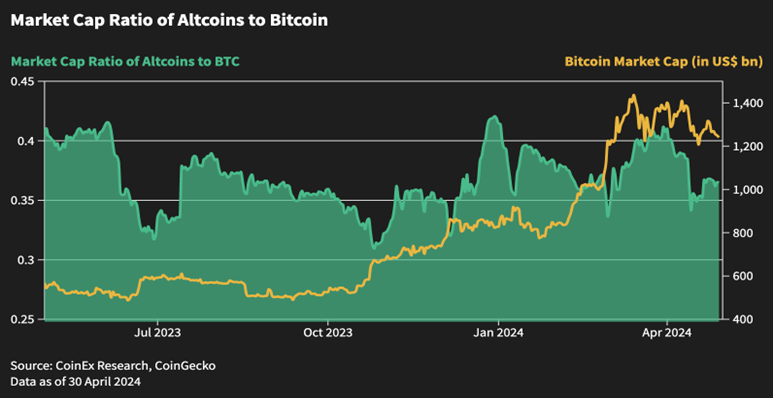

Altcoins, excluding Ethereum, however, faced stagnation relative to Bitcoin, oscillating between 0.3 and 0.4 in terms of the market capitalization ratio. Despite sustained inflows from stablecoins, altcoins struggled to gain momentum, reflecting investor caution amid global economic uncertainties.

Looking Ahead: A Path Forward Amidst Uncertainty

As Bitcoin retraced and economic uncertainties mounted, market sentiment shifted towards risk aversion, triggering widespread liquidation of altcoins. Yet, the underlying liquidity remained robust, signaling potential opportunities on the horizon. With Bitcoin poised to establish a clear trend and broader market stability, investors might anticipate rotation towards the altcoin sector, catalyzing significant inflows into high-quality assets. Whether Bitcoin’s price declines or resumes an upward trajectory, the market is set to experience dynamic shifts, presenting both challenges and opportunities for investors in the months ahead.

For more information visit: www.coinex.com